Autumn 2024 Pulse survey results

Findings from ITI’s latest Pulse survey reveal that market conditions continue to pose challenges, but ITI members are responding by investing in training to update their skills.

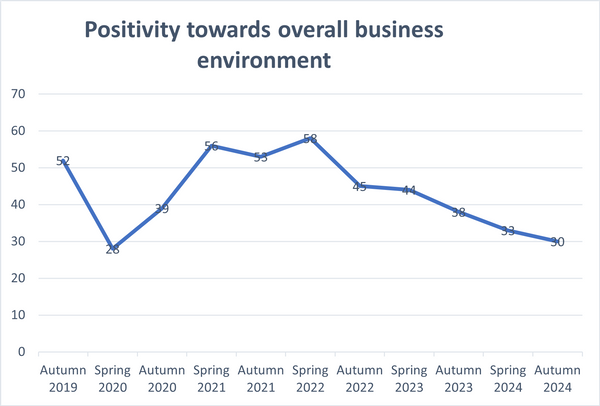

ITI’s Pulse survey provides a snapshot of the translation and interpreting market and how trends and economic pressures have been affecting it. The downward trend in confidence continues, with 30% feeling either ‘very positive’ or ‘positive’ about their work prospects in the current business environment, compared to 33% six months ago.

However, there was an increase in the number feeling ‘neither positive nor negative’ (up from 25% to 30%) and a slight reduction in the number feeling either ‘very negative’ or ‘negative’ (down from 42% to 40%) which may indicate the start of a shift in outlook.

55% of respondents have gained some business from new clients in the last 12 months (down from 58% in spring 2024), with 5% having gained a significant amount (the same as previously). 10% have gained more work from existing clients (9% previously), while 51% reported that the amount of work coming from existing clients has decreased (vs 49% in spring 2024) and a further 9% have lost existing clients (same as previously).

For the majority (51%), earnings per word / contract / hour have remained much the same over the past 12 months. However, there is some good news in relation to earnings. The percentage seeing an improvement has increased to 26% (21% previously) and those experiencing a reduction has reduced to 23% from 27% in spring 2024.

Taking mitigating action and building resilience

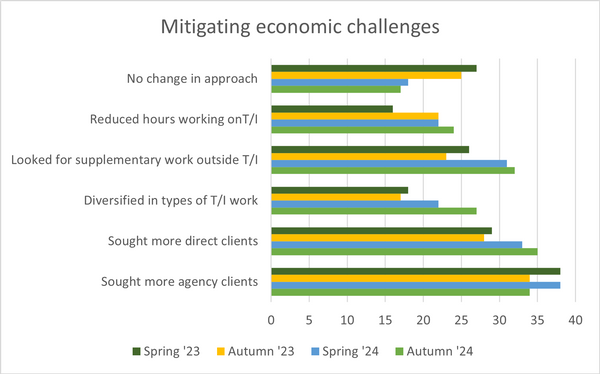

Given the uncertainty in the market, it makes sense that members are continuing to look at ways to replace or boost income, with many having sought either new direct clients or agency clients. Significantly, the number seeking more direct clients has increased from 29% 18 months ago to 35% in this latest survey. This is interesting in light of the preliminary results of the Changing Status project that were presented at the ITI Conference 2024. There are indications that changes in the market are placing stress on the mid-sized language service companies; we have also, sadly, seen a couple of well-respected translation agencies closing their doors this year.

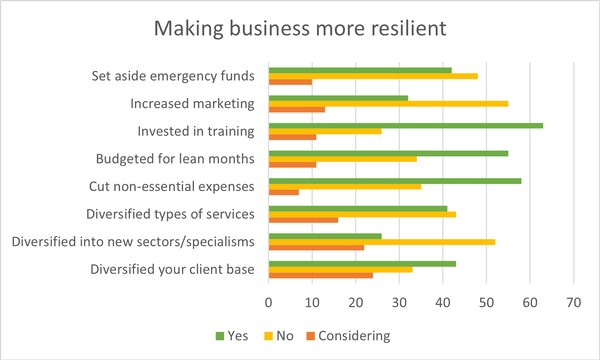

Included in the survey this time was a question about steps respondents have taken to make themselves and their business more resilient. Overall, 63% have already invested in training to update their skills (with a further 11% considering it), 58% have cut non-essential expenses and 43% have diversified their client base.

It is worth noting that those who have a more positive outlook about their work prospects are, on the whole, more likely to have taken mitigating action, compared to those feeling more negative.

72% of those feeling positive have already invested in training vs 53% of those feeling negative. 31% have diversified into new sectors, vs 18% of those feeling negative about their prospects, and 41% have sought more direct clients vs 37%.

So, although conditions may be difficult it appears that those prepared to adapt and develop themselves and their business do feel more optimistic about the future.

Impact of AI

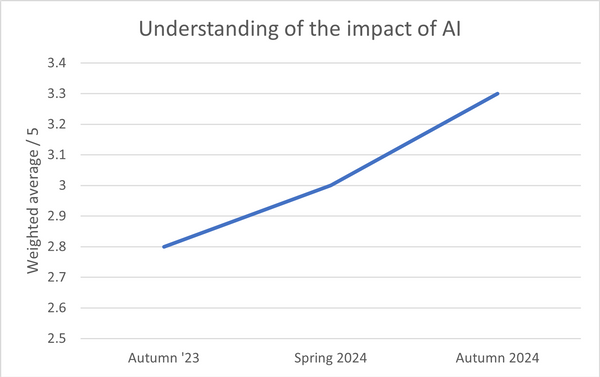

Increasingly, respondents feel they understand the impact generative AI is likely to have on the translation and interpreting sector. This has risen from an average of 2.8 to 3.3 / 5 in the time that we have been tracking it. With this understanding can come concerns, but also the ability to respond in positive ways, as shown above.

42% of respondents are either very or extremely concerned about the potential impact of AI on future earnings, up from 39% six months ago.

The number of respondents incorporating AI tools into their workflow is steadily rising with 24% now making use of them — up from 17% compared to a year ago. This growing interest is reflected in the popularity of ITI’s AI-focused training courses. From the 10-week Translation and AI course in collaboration with the University of Surrey, to workshops introducing AI tools, these have been some of the most popular training we have offered over the last year. ITI remains committed to providing relevant training that will help you to adapt and succeed as the landscape evolves.

ITI training